You heard us say it many times here and during live trading sessions: September is historically the worst month of the year for stocks. But we were careful to note that past performance does not guarantee future results.

And that was certainly the case this year. Stocks ran up following the Federal Reserve’s first interest-rate cut since 2020. In the less than two weeks since the central bank announced a 50-basis-point reduction on Sept. 18, the S&P 500 has advanced roughly 10%, making a new record high.

For the month, the index was up 2% compared with an average 0.6% decline going back to 1945. It just goes to show you that uncertainty is the only certainty.

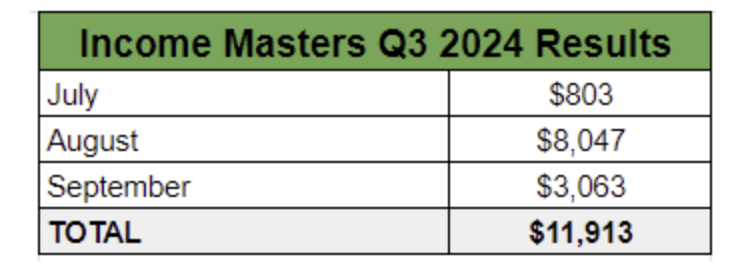

In the Income Masters program, September capped off a strong quarter for members in which we racked up a total of $11,913 in profits in the live account, bringing our year-to-date cash total to just over $22,500.

Looking back over the first nine months of the year, we’ve closed 206 trades in the Income Masters program, 191 of which were profitable, for a win rate of 92.7%. Our Q3 win rate was even better. We closed 63 trades between July and September, 61 winners and only two losers, giving us a 96.8% win rate.

Our Q3 results were boosted by two very successful rounds of Income Madness this summer, which yielded more than $6,000 in cash.

But there were a number of other elements that were crucial to our success as well.

For instance, we actively managed trades that went against us, which has been a big contributor not only to our high win rate but, more importantly, to capital preservation.

Our management of a bearish Tesla (TSLA) trade that immediately went against us was a great example.

We reduced our loss to just $150 on the three contracts we traded on a position that had been deep underwater a few months earlier. We then turned around and traded TSLA using a straddle strategy to take advantage of the high level of volatility in shares without needing to correctly predict which way the stock might move.

We exited that trade with a profit of $604 on two contracts in just three days, more than offsetting the loss from the previous trade.

Then there was our management of a Vertiv Holdings (VRT) position. After nine profitable trades in a row on the stock, we got caught on the wrong side of a 20% two-week drop in shares. Despite rolling several times, the short leg of our bull put spread was well in the money (ITM), and we were assigned 500 shares on the five contracts we sold. So, we turned around and sold the long call for a profit and then sold a covered call on our shares to generate more income.

When we exited the position two weeks later, we booked our largest profit from a single position so far this year, pocketing $1,610 in cash.

In addition to active trade management to limit losses, we have also benefited from the introduction of a number of strategies to help us take advantage of evolving market conditions. These include straddles, which we mentioned above with Tesla, as well as call debit spreads to find trades in periods of low volatility.

We’ve also used bear call spreads to generate high rates of return on stocks such as ailing insurer Humana (HUM) to take advantage of neutral-to-bearish sentiment.

And we have begun to trade a number of stocks Perpetual Income style. Perpetual Income trades are often longer-term plays where we look to continually generate income by selling puts and calls over the course of weeks or even months, in addition to collecting dividend payments. We’ve built up large credits in a number of stocks through a combination of option premium, dividends and capital gains.

We’ve also used this strategy successfully on shorter-term trades, such as a recent member suggestion to trade Qualcomm (QCOM) the day before the stock went ex-dividend. We purchased 100 shares and sold a covered call, securing the $0.85 per-share dividend the next day. We closed the position for a profit of $4.89 per share for a total of $574 and a 3.5% return over our cost basis in two weeks.

These strategies offer a nice supplement to our cash-secured put and bull put spread trades, which make up the bulk of our Income Masters positions.

Members can expect to continue to trade a variety of strategies in the pursuit of income in the fourth quarter. September is behind us, but it appears October is coming with its own set of challenges that the market will need to overcome.

In fact, a Barron’s article published on Oct. 1 welcomed traders to “Shocktober,” listing the myriad reasons investors are spooked. These include escalating tensions in the Middle East, supply chain disruption from the port strikes, a Fed that still looks to be moving cautiously and a host of employment reports due out this week.

Traders may be in for a few scares this month, but we we’ve proven over the course of the year the value of patience and a steady hand, especially while others are running scared.