Not long ago, everyone talked about electric vehicles taking over power grids and causing cities to crumble. It was a rallying cry for those against the likes of Tesla. Automotive manufacturers were slow to retool plants and invest in electric vehicle infrastructure and now that they are caught up, the EV movement has lost momentum. However, it’s not EVs that will bring the power grids to a grinding halt. It is, however, something else that is growing in popularity and will soon become a real problem that can’t be ignored.

U.S. data centers will outstrip the power supply later this decade. Cities, and the country, need to be equipped to handle the unprecedented power demand caused by the artificial intelligence (AI) revolution.

There are estimates that utilities will need to increase power generation by 26% from 2023 levels. To put that into perspective, that is a greater increase than the U.S. has been able to do in the past two decades.

What does this all mean? Will the streets go dark?

For starters, utilities will go on a spending spree to increase infrastructure and will have to pass that on to their consumers at a rate that will far exceed inflation. To put it another way, your electricity bill is going to skyrocket!

At a recent wholesale power auction, prices closed nearly 10 times the level set just two short years ago. With data centers currently making up 44% of demand, this number will increase as companies rush to develop and implement the next phase of their AI plans.

What can you do about it?

From an investment standpoint (and I should remind you I’m not a registered financial consultant), you can get exposure to an energy ETF or stocks within the energy space.

Take, for example, NRG Energy (NRG). They are a leading power company offering millions of customers electricity generation with a diversified portfolio of power plants, utilizing natural gas, coal, and renewable energy.

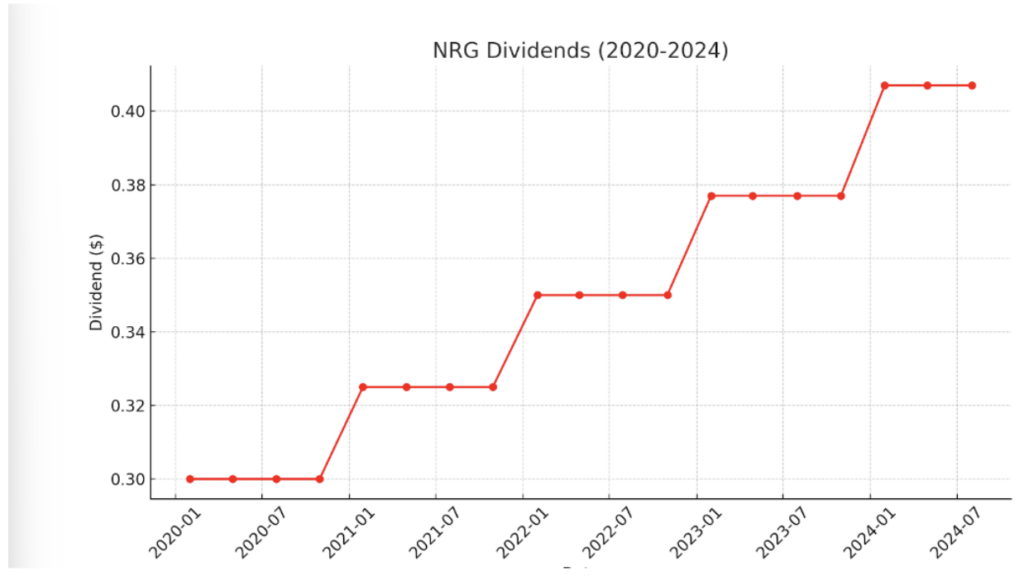

They have a history of increasing their dividend payout to help you with your income-generating goals too.

There are a couple other stocks you can add to your watchlist. Ones like NextEra Energy (NEE).

And Vistra Energy (VST) is another one worth a glance.

You can get into the broader energy sector by trading the S&P 500 Energy Sector ETF, XLE, but that has exposure to industries like natural gas and oil, so there are other things you may want to look at like geopolitical news and seasonal patterns.

You can see from the chart that the overall energy sector has been in a bit of a downtrend, even though the stocks I mentioned earlier are moving higher.

Either way, prepare yourself for paying extra every time you turn on your trading computer, because your electric bill is surely set to increase in the near future. But you can take action to lessen the blow.