The iron condor is a popular neutral options strategy designed to profit from a stock staying within a defined range over a specific period. It’s particularly useful during earnings season when you expect the stock to move, but not as much as the market implies. This strategy allows you to take advantage of elevated volatility while capping both risk and reward.

What Is an Iron Condor?

An iron condor consists of four option legs:

- Sell an out-of-the-money call (higher strike)

- Buy an out-of-the-money call (even higher strike)

- Sell an out-of-the-money put (lower strike)

- Buy an out-of-the-money put (even lower strike)

These four legs form two spreads: a bear call spread and a bull put spread, which together create a range. The goal is for the stock price to stay between the short strike prices (the sold call and sold put) until expiration.

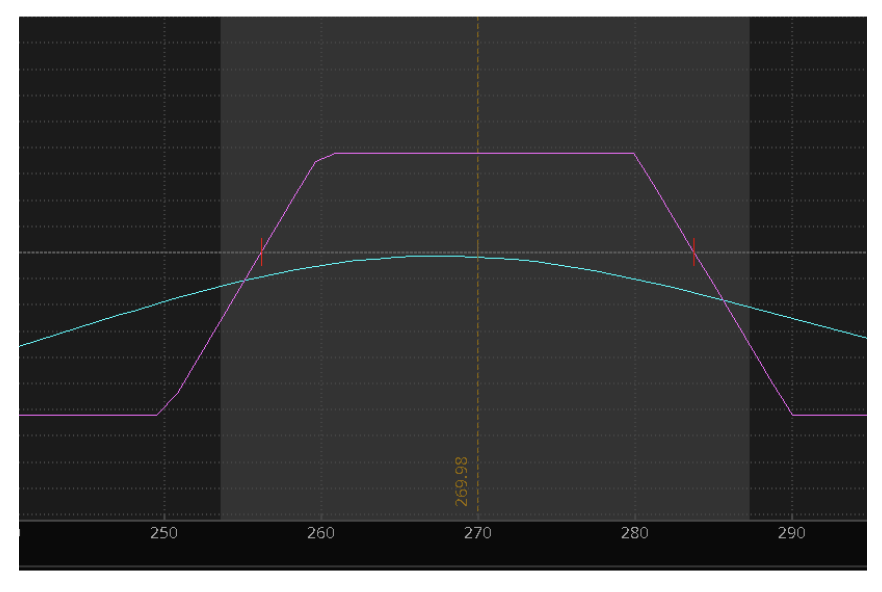

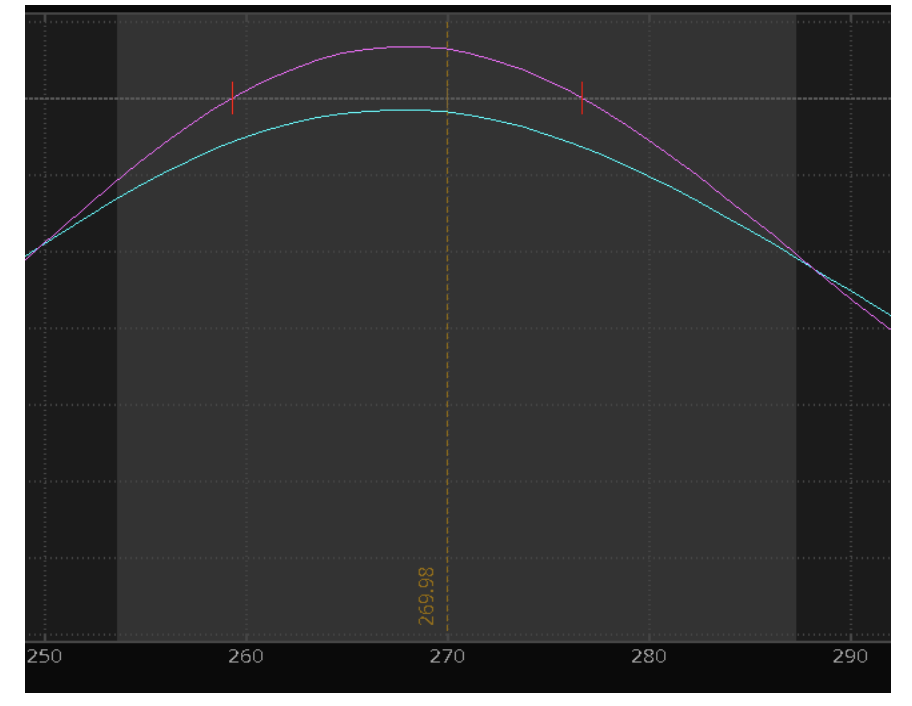

The profit loss graph looks like a top hat, with the short strikes creating the edge of the hat.

Why Use an Iron Condor for Earnings?

Earnings season can bring heightened volatility as investors speculate on how a company’s results might affect its stock price. However, market expectations are often overstated, leading to inflated option premiums and implied volatility (IV). This is where an iron condor shines. If you expect the stock to remain within a specific range after earnings, you can sell an iron condor to capture premium from the heightened IV without taking a directional bet.

Here’s why you might use an iron condor over earnings:

- Limited Risk, Limited Reward: The maximum profit from an iron condor is the net credit received when setting up the trade, and the distance between the strike prices of the spreads caps the maximum loss. This makes it a relatively low-risk strategy compared to buying naked options.

- Benefit from High Implied Volatility: Earnings announcements typically cause IV to rise before the event, increasing option premiums. By selling options (which you do with an iron condor), you can collect a higher premium, giving you more room for profit as long as the stock stays within your range.

- Neutral Outlook: If you believe the stock is unlikely to move significantly after earnings and will remain within a defined range, an iron condor allows you to profit from that neutral view.

The Role of Volatility and Volatility Crush

Volatility plays a significant role in the iron condor strategy, especially during earnings season. Implied volatility tends to rise before earnings, driving up the prices of options due to the anticipation of a large move. This pre-earnings surge in IV is what makes iron condors attractive during this period, as you can sell high-priced options.

Volatility Crush and Its Impact

Once the earnings report is released, the uncertainty is resolved, and implied volatility tends to collapse—this is known as the volatility crush. For an iron condor, this is generally a positive outcome. When volatility decreases, the price of the sold options declines, making it easier to close the position at a profit, as long as the stock remains within the desired range.

Now look at the same profit and loss graph as before, but this time this is what it looks like when volatility drops a mere 5% in a day, which is very likely during earnings. All other items remaining equal, a 5% reduction in volatility turned a slight loss (teal line) into a $50 win (purple line).

However, the stock still needs to stay within the boundaries of the iron condor for the trade to be profitable. If the stock makes a large move, breaking out of the range defined by the sold strikes, you could face a loss.

Benefits of Volatility Crush for an Iron Condor:

- The drop in IV helps reduce the value of the options you sold, making it easier to capture profits.

- Because you’re selling options when volatility is high, you can collect a larger premium, offering a more favorable risk/reward profile.

Risks:

- If the stock makes a large move outside of your iron condor range, the strategy can result in a loss.

- The iron condor is a defined-risk trade, but the closer the stock moves to either of the sold strikes, the more you risk losing part of your premium, or potentially taking the maximum loss.

An iron condor is an ideal strategy for you if you expect a stock to stay within a certain range during earnings but want to take advantage of inflated option premiums due to heightened volatility. By profiting from the volatility crush and keeping the stock price within the sold strikes, an iron condor can provide a reliable way to capture premium with limited risk during earnings season. However, it’s essential to be mindful of any potential large moves that could push the stock outside of your defined range.

Trading around earnings comes down to a few key factors. Do you believe the stock is likely to move strongly in one direction or another? Does it have a history of doing so or is there a catalyst that will move the direction? If so, a long straddle may work for you.

If you have a strong directional bias, a short put or short call spread is a great way to take advantage of elevated premiums and the premium crush that typically comes after earnings.

Lastly, if you are unsure about the direction of the stock, but don’t believe it is likely to move too far one way or another, the iron condor is a great strategy to take advantage of premium crush.

That’s it for me this week. The team will be back next week to review some trades and review where we are in the market and where we could be heading next.

Have a great weekend!