Christmas is canceled this year so start setting expectations early. Santa and his elves are likely going on strike in the coming weeks right in time for the election and for a busy holiday season. I haven’t lost my mind – I know Santa doesn’t exist, but the looming shipping crisis is around the corner and could have a major impact on some key industries within the broader market. Is your portfolio prepared?

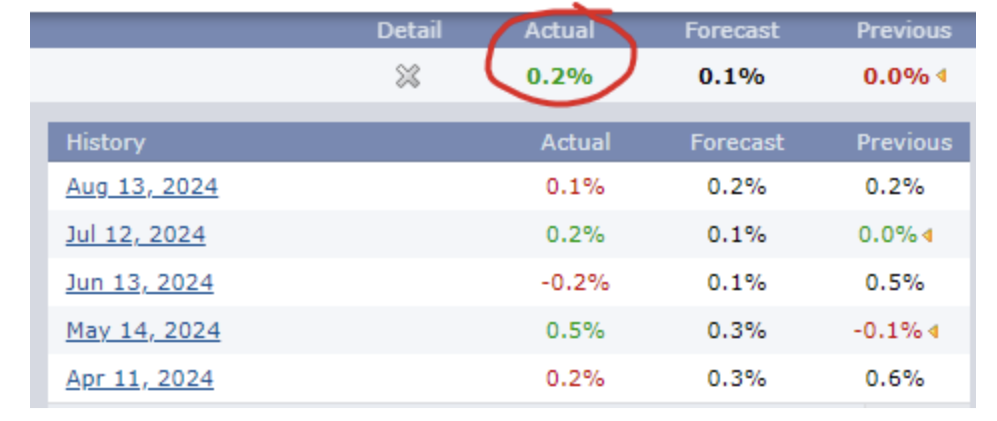

Let’s start a few weeks ago when the Producer Price Index reported an uptick from 0.0% to 0.2% month-over-month. That may not seem like much on the surface – it certainly wasn’t the highest change in the last few months, but there was something going on under the surface.

Companies have been frontrunning prices with the assumption that the International Longshoremen’s Association (ILA) would strike in October when their contract runs out. The ILA strike would impact 13 ports of call along the east coast. Those ports bring in over 20 million containers of goods per year. That equates to 55,000 containers per day. To put things into perspective, each container can hold 400 flat screen TVs or 50-60 refrigerators. You know, the hot selling items around the holidays.

If that wasn’t bad enough, the United States Maritime Alliance (USMX) is looking to join in. Both groups – the ILA and USMX are locked in a negotiation over a new Master Contract.

How would that affect the economy and jobs? Just the Savannah, Georgia port and terminals alone support over 561,000 jobs.

This also means the potential for distrupting holiday shipments of… well… everything! Manufacturing supply chains would grind to a halt. For some retailers, over half of their annual sales come from the holiday season.

The National Retail Federation (NRF) and Retail Industry Leaders Association (RILA) said that retailers will be forced into costly mitigation strategies that will cause inflation to head higher.

The retail industry and the broader stock market will feel the effects of such a strike.

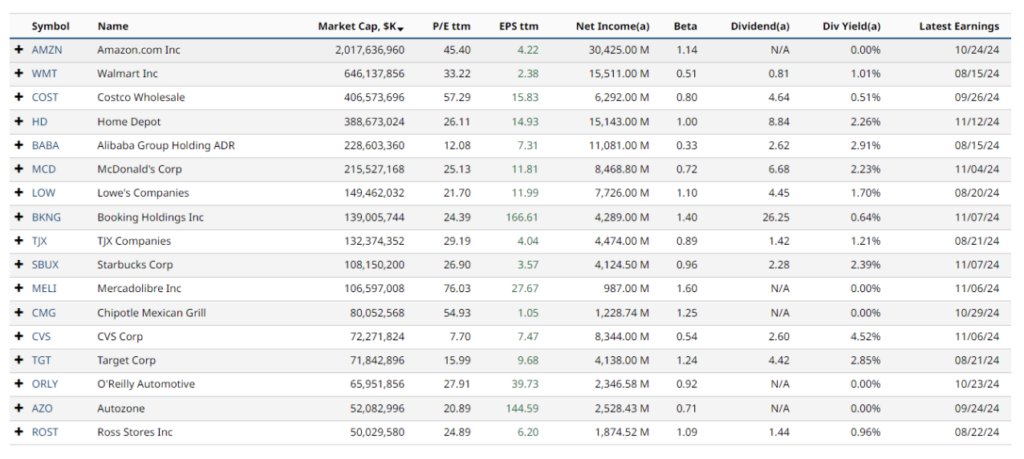

In terms of retailers, here is a list of the top companies by Market Cap that could be greatly impacted by the strike right before the holiday season.

Many of these companies are in the S&P 500 Consumer Discretionary ETF (ticker XLY). You wouldn’t necessarily think anything is lurking below the surface given how strong the sector has performed in recent weeks. We will see how well it does in October.

What’s interesting to me is that the Implied Volatility Rank of the ETF is 22.06, which is near 1-year lows.

In theory, that makes options for this ETF relatively cheap compared to historical volatility. With a binary event coming up – will there or won’t there be a strike on October 1st – a trader can take advantage of low implied volatility by purchasing a long call and a long put at the same strike price and at the same expiration. This is called a Straddle.

For example, let’s look at the 18 OCT option expiration cycle with the ETF trading around $200. A trader can buy the 18 OCT 200 call and at the same time buy an 18 OCT 200 put. The combined debit of this trade is around 7.06, or $706 per contract.

If a call spread increases in value if the underlying rises in price and a put spread increases in value if the underlying drops in price, how does a straddle make money?

The trick here is to buy relatively cheap options and have the underlying move strongly in one direction or another. If the move is strong enough, the option that makes money will increase in value faster than the option losing its value. The net change between the two is your profit.

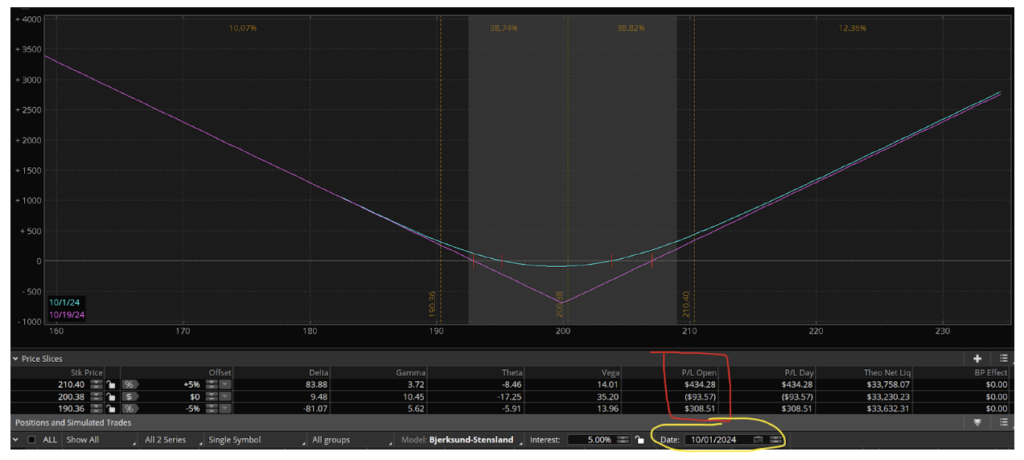

The profit/loss graph of straddles look like a ‘V’ like this:

Using our options simulator, we can simulate the price of this straddle on October 1st, should the XLY move up or down by 5%. If the workers call off the strike and that causes the XLY to move up 5% from current levels by October 1st, the trade would net a $434 gain. If the XLY falls by 5% between now and October 1st, the trade would have a net profit of $308. You can see that the P/L of each side is rarely symmetrical, but the potential for profit exists on both sides as long as the XLY has a strong move in either direction.

Since you’re buying two options (a long call and a long put), time is not your friend. With each passing day, and all other factors equal, options will lose value due to the expiration/time component. You can see on the P/L graph, the worst case scenario is that XLY stays at the $200 level. The long call loses time value as does the long put. That would mean roughly a $93 loss by October 1st.

We don’t know what the result of the strike will be or how the market will react. We don’t know if XLY will jump higher or drop lower by 5%, but since the strike is a binary event set to take place on October 1st, you could decide to shut the trade down on that day no matter what happens. As of this simulation, the risk is about $100 with the opportunity to make somewhere between $300 and $400. Since you’re playing both sides of the coin, it doesn’t really matter if the ILA strikes, as long as XLY has a strong reaction to the event.

You can also check out different expiration cycles and I’d recommend looking at the P/L graph during market hours since option prices do get wonky (technical term) after hours and that’s what I used here.

What do you think? Will a strike happen? Will the President get involved? Are you ready this year is Santa and his elves go on strike on October?