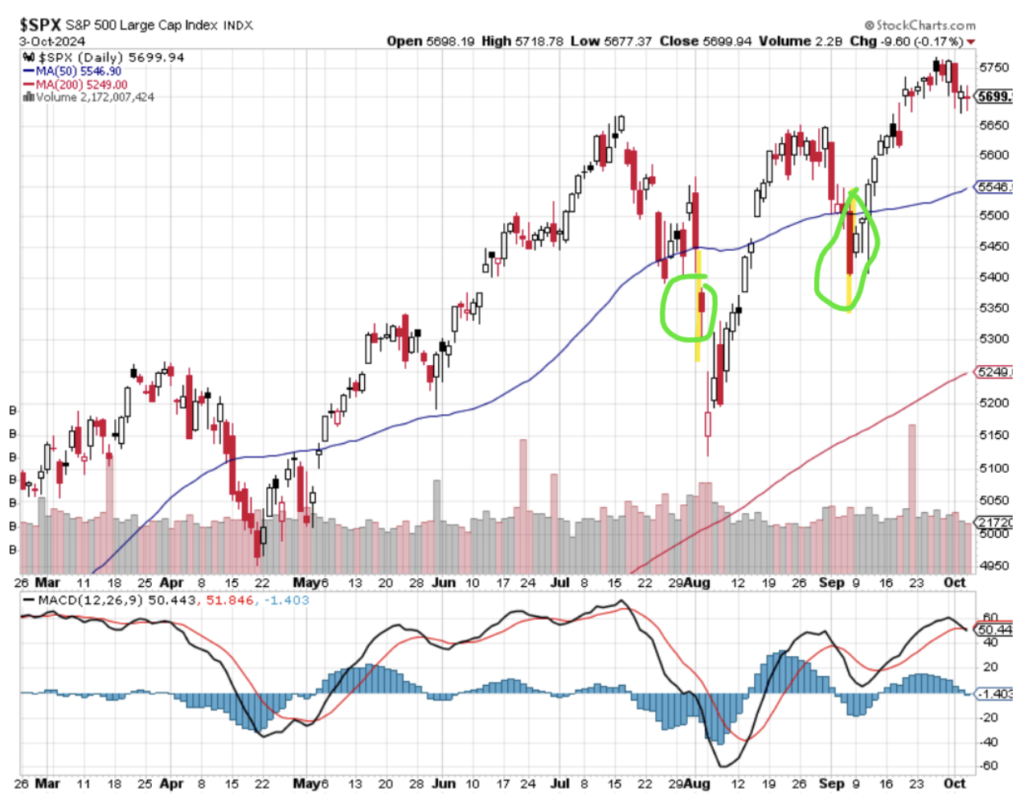

The Middle East conflict is certainly important, but I don’t believe it’s the main driver of the slowing momentum we’ve seen in the last few trading sessions. The S&P 500 as shown in this graph was near a cycle high at the time the escalation started. And despite what is going on, the market is finding a level of support at the previous cycle high. In other words, this is normal market behavior, despite the news.

Now, that could all change if the Middle East turns into an all-out war zone, but back in the U.S., all eyes are more focused on jobs data. Remember, the Fed has said they are watching the job market as a way to gauge future rate cuts.

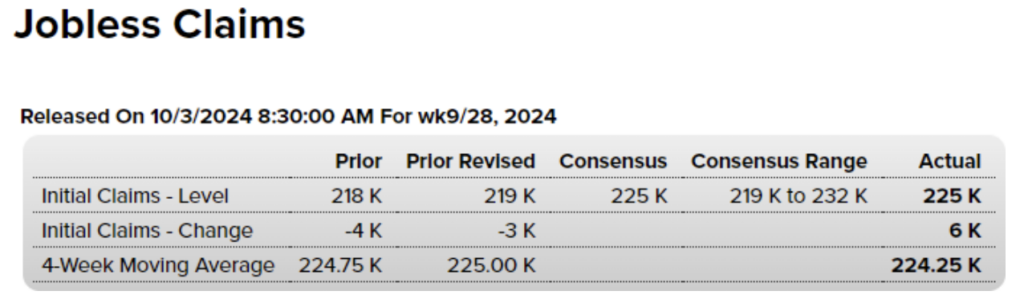

First up, the weekly jobless claims came in slightly higher than last week, but the 4-week moving average actually ticked lower. Either way, it’s staying at a nice, consistent level and not showing signs of spiking higher.

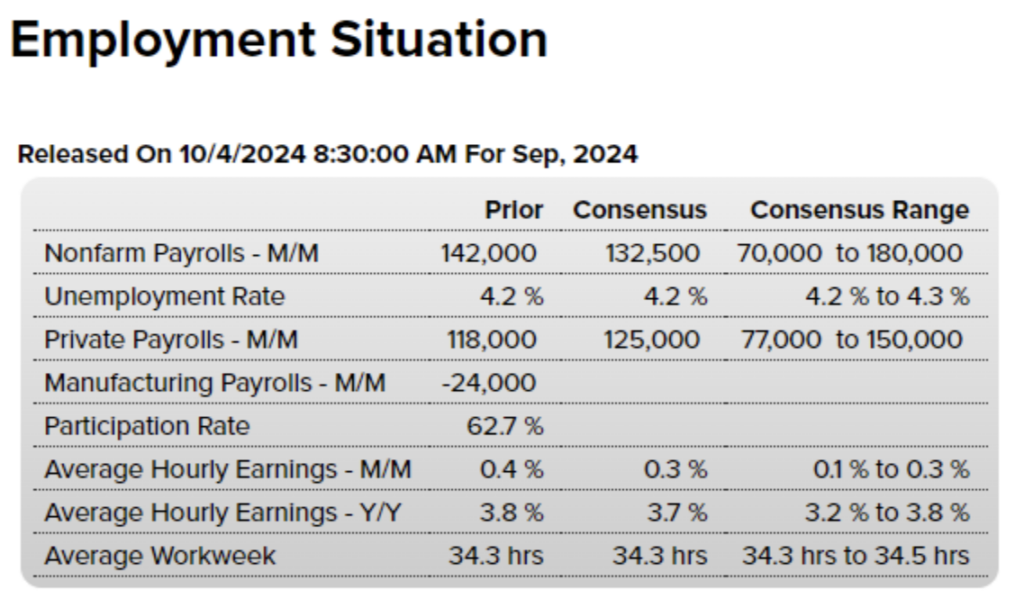

There’s more to the story though. It comes in the form of the Employment report, coming out pre-market on Friday (today). The unemployment rate is expected to stay flat at 4.2 – 4.3%.

Despite the initial rate cut of 50 basis points, the Fed doesn’t expect to see the jobs data start to fundamentally change for another month, but they are expecting to see the data improve.

However, let’s look at the history of the S&P 500 during the last two jobs reports. They are highlighted and circled in the chart below. In both cases, the market reacted poorly on the day of the report but did eventually find a bottom and trade higher over the following week. So don’t get discouraged if we see something similar this time around.

Let’s not forget that the U.S. Presidential election is about a month away. As much as estimates are showing potential for a positive earnings season to help move stocks higher, I’m still predicting a fair amount of volatility in this market for October, so keep your trading management in check because we should see some incredible trading opportunities through the end of the year, but we need to get through October first.

As much as we talk about stocks and making money – just take a moment and recognize how precious life is. We tend to gloss over the humanitarian crisis at home from hurricanes and abroad from conflict. Take a moment and appreciate what you have, and enjoy the weekend!