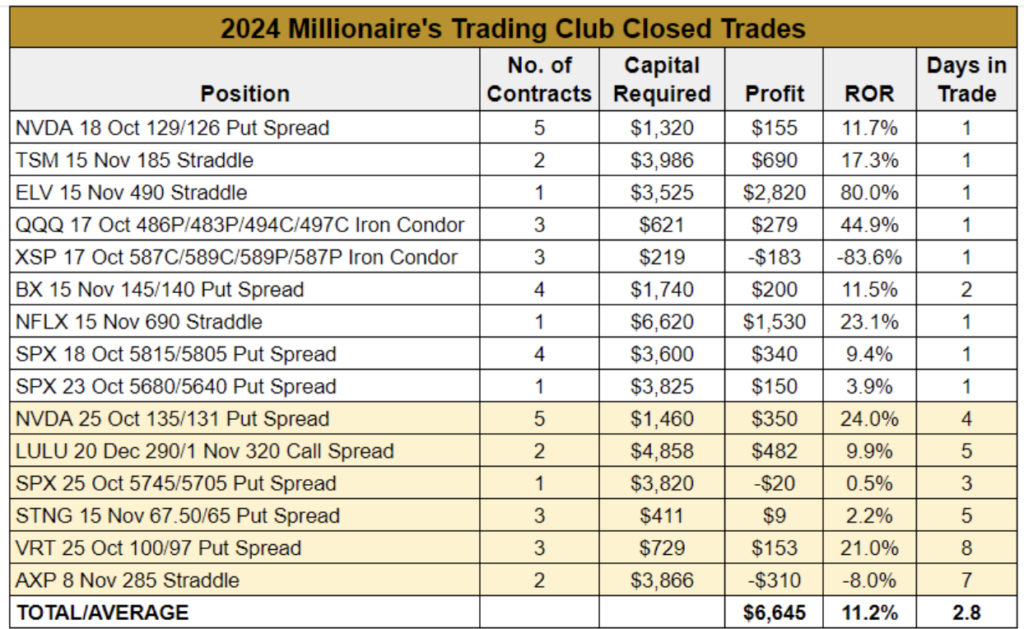

Last week, we shared our preliminary results from the three-day Millionaire’s Trading Club live event in Las Vegas. We put on 25 trades during that time, closing out nine of them before we wrapped the event, pocketing $5,981 in cash.

Last week, we closed another six trades, bringing our net cash to $6,645. What’s more, we averaged a 11.2% return per trade with an average holding time of less than three days.

Earnings season was just beginning as we kicked off the live MTC event, which ran from Oct. 16-18, and we took full advantage of this.

Some traders shy away from trading earnings due to the unpredictability associated with them. Earnings reports are, after all, binary events. A company will either exceed or miss estimates. A stock will either trade higher or lower after the announcements. (Yes, companies can meet expectations and stocks can remain flat, but you get the point.)

Because no one has a crystal ball, it’s impossible to predict whether a company will beat or disappoint. And it’s even harder to predict how investors will react (if there’s such a thing as harder than impossible).

But as Traders Reserve’s Jeff Wood outlined in his recent series on trading earnings events, there are a number of strategies options traders can use to capitalize on the heightened volatility associated with earnings season.

If you missed Jeff’s articles, I highly recommend you check them out. In Strategies You Can Use for Earnings Season Part 1, Jeff covers:

Long Straddles: A limited-risk strategy that allows traders to profit from large stock movements in either direction.

Bull Put Spreads: A neutral-to-bullish strategy that allows option sellers to benefit from the volatility crush that is typically seen after a company announces.

In Strategies You Can Use for Earnings Season Part 2, Jeff covers:

Iron Condors: A neutral strategy that takes advantage of inflated option premiums due to heightened volatility and allows traders to profit when a stock remains within a specific range after earnings.

We employed all three of these strategies during the Millionaire’s Trading Club event.

Last week, we covered our success with pre-earnings straddles, noting wins on Taiwan Semiconductor Manufacturing (TSM) and Netflix (NFLX) after the companies beat estimates and made sharp moves higher.

Long straddles involve buying a call and a put option at the same strike price and same expiration date, thus eliminating the need to correctly guess which way a stock will move after earnings. This allows us to profit from both bullish moves, like we did with TSM and NFLX, as well as bearish moves as we did with Elevance Health (ELV).

The ELV straddle was a standout, becoming our highest-earning trade of the event. We closed the position with a $2,820 per-contract profit for an 80% return in less than 24 hours after the health insurance provider missed estimates and issued a soft outlook.

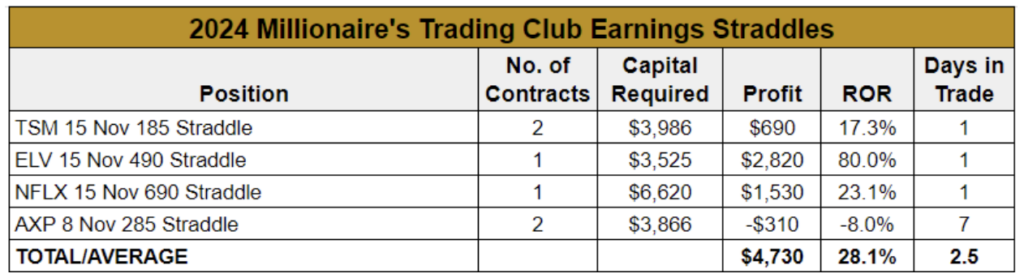

The table below shows the outcome of the MTC earnings straddles we’ve closed for far:

As you can see above, our most recent straddle closeout resulted in a loss. This trade perfectly illustrates the risk associated with long straddles, namely that the underlying does not move enough to compensate for the post-earnings drop in implied volatility (IV), causing the trade to lose value quickly.

American Express (AXP) reported third-quarter earnings on Oct. 18, beating Wall Street’s profit estimates and raising full-year guidance, yet shares traded lower on the news, falling around 2%. But the move was not far enough or fast enough to move our straddle into profit territory.

So, we shut down the trade, choosing to book the loss rather than let theta decay continue to drain premium from the position. But as you can see above, this $310 loss was more than offset by the three winning straddles.

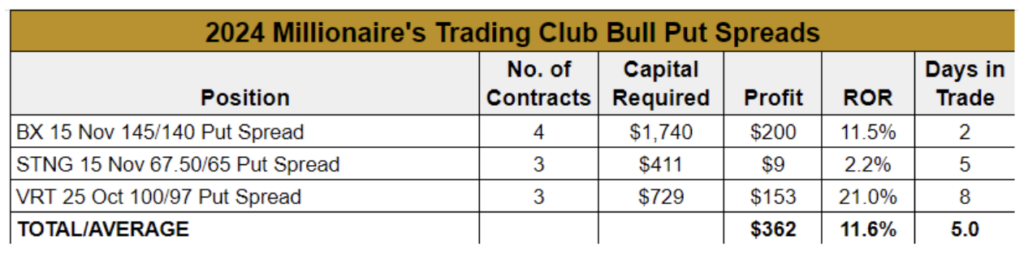

We’ve also had success with our pre-earnings bull put spreads from the MTC event.

While an earnings straddle is ideal when you expect a big post-earnings move but are unsure of the direction, a bull put spread – which involves selling a higher-strike put and buying a lower-strike put for a net credit — offers a way to limit your risk when you expect a stock to rise after earnings. As we mentioned above, this strategy allows you to take advantage of the volatility crush that typically happens after a company reports.

During the first day of our Millionaire’s Trading Club event on Oct. 16, we used this tactic with Blackstone (BX).

Blackstone is the world’s largest alternative asset manager, with more than $1 trillion in assets under management. The company was due to report earnings before the market open the next day.

Given the company’s rock-solid fundamentals and management team combined with an expectation of an earnings beat, we viewed it as an excellent bull put spread candidate.

The average implied move was around 3%. With the stock trading around $159.66 that day, that implied a move down to about $154 or up to about $165.

After reviewing the stock’s recent post-earnings move, we sold the BX 15 Nov 145 Put and bought the BX 15 Nov 140 Put for a net credit of $0.65, or $65 per contract. We traded four contracts, bringing in a total of $260.

Since this was a 5-wide spread, the capital required was $500 per spread, or $2,000 total, less the credit brought in, or $1,740. And we set a profit target of $0.15, placing a good ‘til canceled (GTC) order to exit the position at that level.

The 145 short strike was around 9% below the current share price and about 6% below the expected move, providing a nice cushion. Although it was certainly possible that BX could move below that level, especially if the company issued weak guidance. But the fact that the trade had 30 days to expiration (DTE) gave us some flexibility to manage it should shares fall sharply.

But Blackstone reported strong third-quarter results the next morning, beating revenue and earnings estimates. Shares rallied to a new all-time high, hitting our target exit price the next day and allowing us to book a $200 profit on four contracts for an 11.5% return on risk in two days.

The BX bull put spread benefited from a post-earnings rally, with shares rising nearly 8% between when we entered and exited the position. However, our Vertiv Holdings (VRT) position highlights the power of bull put spreads as a neutral strategy.

Shares of the company, which provide infrastructure technology for AI data centers, were trading at $111.79 when we sold the VRT 25 Oct 100/97 Put Spread for $0.57 a few days before the company was set to announce third-quarter earnings. We traded three contracts, collecting $171 in premium. We chose not to set a GTC order, preferring to see how far shares might run after the announcement.

Vertiv reported better-than-expected Q3 results, but mixed guidance and a broader market sell-off resulted in shares falling as much as 7% before closing the day down around 3.7%. However, even at its intraday low of $104.52, the stock remained comfortably above our sold put strike.

VRT moved higher the next day, although the share price remained about 2% below where we entered the trade. However, this was offset by the volatility crush the options experienced following earnings.

As Jeff discussed last week, implied volatility tends to increase leading up to earnings, inflating option prices. Once the report is out, the IV collapses — regardless of the stock’s price movement — causing the value of its options to decrease, sometimes sharply.

When you trade bull put spreads, you benefit from the post-earnings volatility crush as we saw with VRT. We closed the trade for $0.06 per contract, resulting in a profit of $0.51, or $51 per contract, and $153 for three contracts for a 21% return on our 3-wide spread.

These trades go to show you that you don’t need to sit on the sidelines during earnings season provided you have the right tools in your trading toolbox to help limit risk and profit from a variety of post-earnings outcomes.

With earnings season getting into full swing, you can try putting these strategies to work in your own portfolio.