It’s no secret that the market rallied post-election, jumping nearly 5% in a week.

The S&P 500 has gained about 25% year-to-date, following last year’s impressive 20% climb.

August’s fears of a market collapse feel like a distant memory.

The inevitable question is why is the marketing taking a pause here?

Why the Market Is Stalling

One reason for the pullback is profit-taking. Many investors, wary of election-related uncertainty, pulled money out of the market beforehand. After the dust settled, funds flowed back into stocks, boosting the post-election rally. Now, with election excitement fading, investors are re-evaluating valuations, especially in Trump-sensitive sectors like regional banks (KRE).

The Inflation Challenge

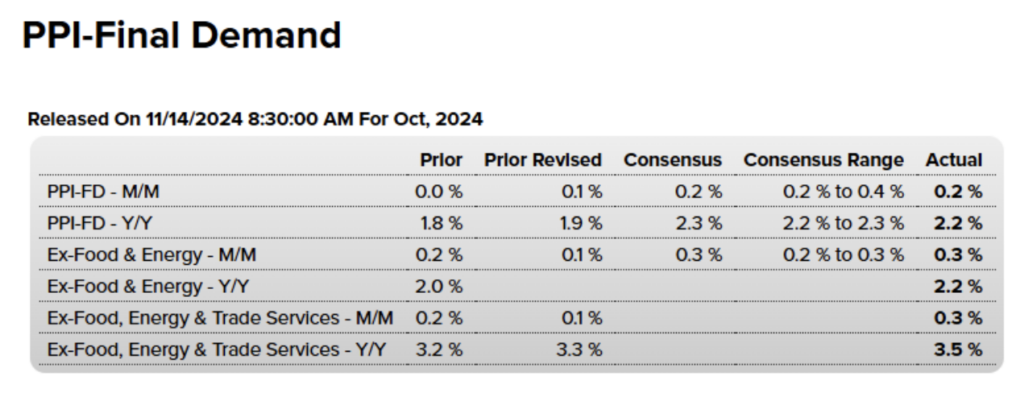

Beneath the headlines, inflation remains the central concern. Although the economy is eyeing a “soft landing” and optimistic projections are everywhere, inflation refuses to cool down. The latest Producer Price Index report showed a year-over-year rise from 3.3% to 3.5% in core prices (excluding food, energy, and trade services).

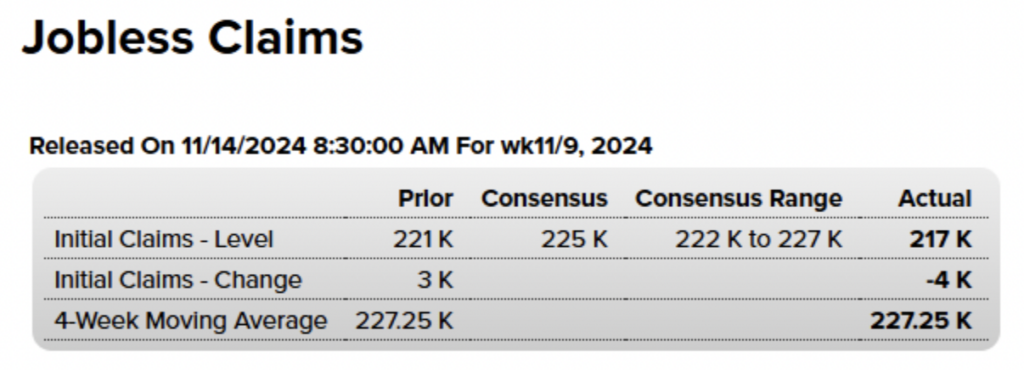

This puts the Fed in a tough spot. With jobless claims near historic lows and a potentially resurgent economy under Trump, inflationary pressures may come roaring back. Stronger demand usually drives prices higher, and the Fed may need to respond.

Powell’s Response: A Cautious Approach to Rate Cuts

The market’s recent weakness stems partly from Powell’s comments. He signaled that the Fed will be cautious about rate cuts, in part because inflation remains stubbornly high. “The economy is not sending any signals that we need to be in a hurry to lower rates,” Powell stated. “The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully.”

The Fed’s benchmark rate influences borrowing costs across the economy—mortgages, auto loans, credit cards—and Powell’s cautious stance reflects the balance the Fed needs to strike in managing growth without stoking inflation.

Trump’s policies, however, have already influenced Treasury yields, as investors brace for faster growth, larger budget deficits, and potentially higher inflation if Trump enacts tariffs and restrictive immigration measures.

Looking Ahead

Though the market has been mixed recently, this dip may be temporary. If economic optimism continues, we could soon retest key levels, including the psychological $6,000 mark on the S&P.

Enjoy your weekend, everyone. Remember, life is precious, and the market will still be here when Monday rolls around.