Market Snapshot: Inauguration Day Moves

The SPDR S&P 500 ETF Trust (SPY) climbed 0.83% to close at $603.05, reflecting renewed enthusiasm in large-cap equities. The SPY seems to be on its way to challenging the pre-inauguration highs around $608, a welcome change after the index broke down through the long-term trend channel and moved sideways for two months.

The Dow Jones Industrial Average (DIA) made an even stronger showing, gaining 1.22% to end the day at $440.10, as blue-chip stocks led the charge. Both indices responded positively to expectations of policy clarity and economic acceleration.

Both indices are showing some initial resistance just above current levels, but market optimism remains high enough to blow through those levels unless earnings reports become the party pooper.

What’s Driving Optimism?

Investors are eyeing several key pillars of the Trump administration’s economic strategy:

- Corporate Tax Cuts: Reduced tax burdens could improve profitability, particularly for U.S.-based companies.

- Deregulation: Sectors such as energy, banking, and manufacturing are poised to benefit from looser regulatory frameworks.

- Infrastructure Spending: Anticipation of significant federal investment in infrastructure projects could provide a major boost to the construction and industrial sectors.

While we don’t talk a lot about Cryptocurrency, it’s going to be hard to ignore under the new president. With Gary Gensler, the belt-tightening Chair of the Securities and Exchange Commission, on his way out and the new president, who took in millions of donation dollars from crypto-bros, promising to deregulate the industry, crypto is now back on the map and investors are loving it. Bitcoin soared past the $109,000 mark, marking a historic high.

We could see Bitcoin heading to somewhere between $125,000 and $150,000 by the time May rolls around.

Sector Highlights

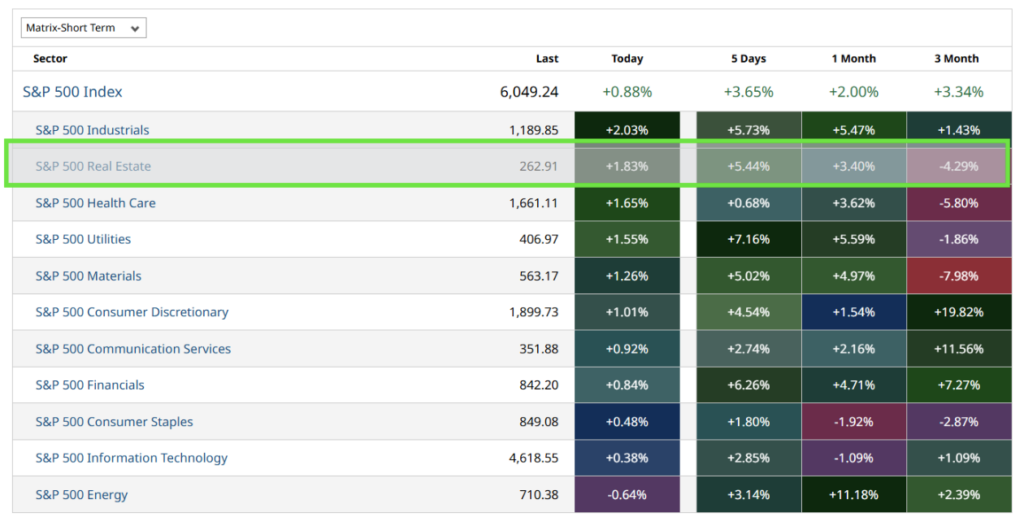

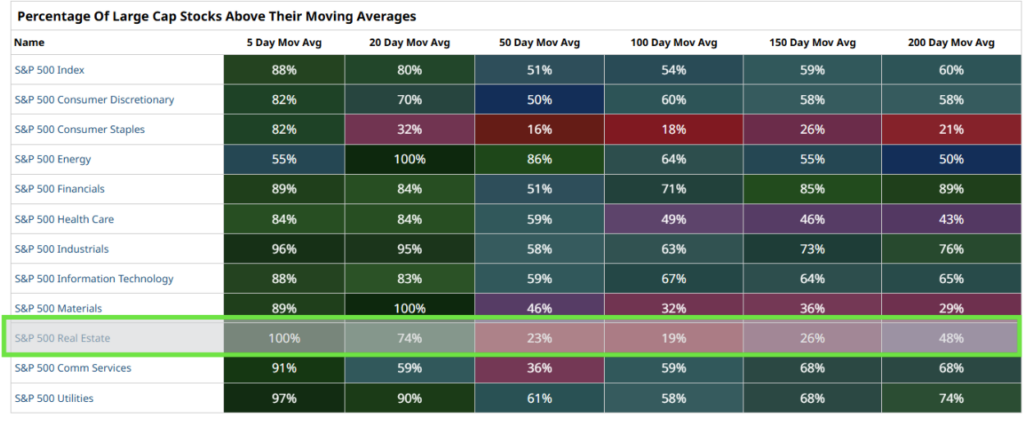

Some of the best-performing stocks on Tuesday were not in the best-performing sectors though. This could be the start of a sector rotation or a result of an oversold market. For example, the S&P 500 Real Estate sector closed Tuesday with a 1.83% gain, marking a 5.44% gain over the last five days, but you can see that over the last 3-month period it has been one of the worst performers.

It wasn’t long ago that the S&P 500 Real Estate sector had 0% of stocks trading above their respective 20-day moving averages. Now, that number has skyrocketed to 74%. That’s quite the turnaround considering only 23% of the stocks are above their 50-day moving average.

Volatility in Check

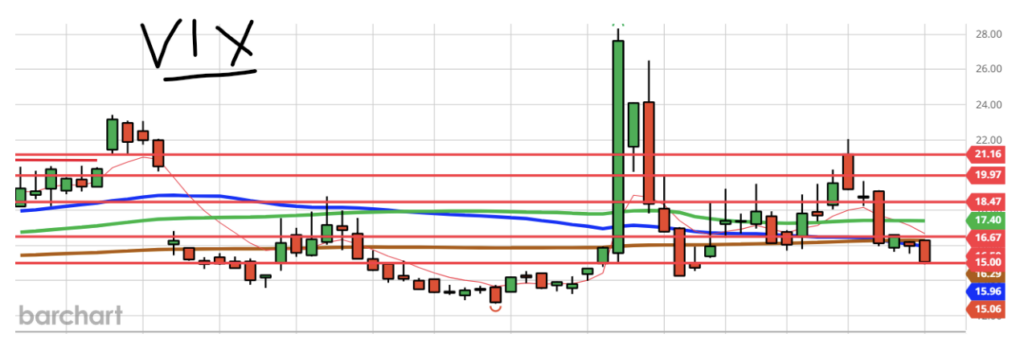

The CBOE Volatility Index (VIX), often referred to as Wall Street’s “fear gauge,” remained relatively subdued, closing near 15! This signals a degree of confidence among investors, even as some analysts cautioned about the long-term impact of proposed tariffs and restrictive immigration policies. The VIX has certainly been lower recently (down to around 12.63 in December 2024), but it’s getting to an area of interest where we could see a rise in volatility.

Risks on the Horizon

While markets have celebrated the inauguration with gains, concerns remain about potential inflationary pressures from tariffs and restrictive trade policies. These factors could lead to higher costs for businesses and consumers alike, potentially curbing economic growth in the long term. History is not on the Republican’s side when it comes to GDP growth, but that’s a story for another day.

Looking Ahead

Watch for legislative clarity and action within sectors as the new administration begins its tenure. How will the Federal Reserve respond to any inflationary pressures and how international markets will react to U.S. policy shifts?

The next few weeks may present both opportunities and risks. Be prepared for potential volatility in sectors tied to trade and fiscal policy.

I’ll be back on Friday to close out the first official week of the new President.