To be fair, the word ‘crash’ may be harsh, but I do think a 5-10% correction could be in the cards if a few items don’t go in the right direction.

Call me a cynic, but I don’t think the election will end on November 5th. With stories of ballet boxes being burned ahead of time, I think the depravity of some American citizens is just beginning to bubble to the surface. I expect volatility to continue through the election and potentially for weeks to come. We could easily see the volatility index (VIX) rise above 20 and retest the 30 print set in August.

Earnings are another catalyst with revenue and projections falling behind 1, 2, and even 5-year averages. The market was already trading at a sky-high 21x multiple, so I’m not surprised to see the market struggle to project higher revenue and profit into the future, but that doesn’t bode well for the current market.

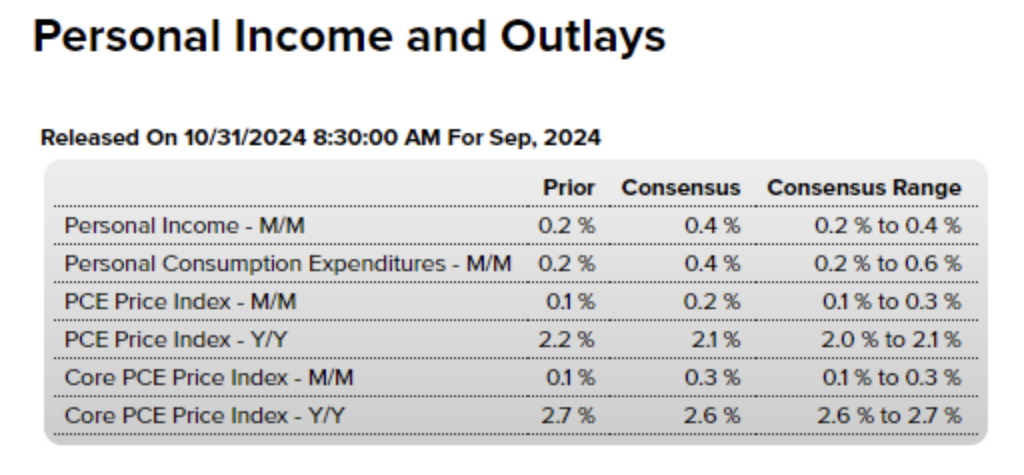

Next is the Fed meeting in the first week of November. They will decide if we’re going to get another rate cut and if so, how much. The current estimates are a 0.25 basis point cut, but that may depend on how the upcoming PCE and Jobs reports go.

After the last 0.50 basis point cut, there are some early signs that inflation is coming back, but a data point here and there does not equal a trend, so we will see. The Fed’s favorite inflation barometer, Core PCE, is set to show an increase this month, going from 0.1% to 0.3%. We could see a negative market reaction if the Fed decides to keep rates where they are instead of making another cut.

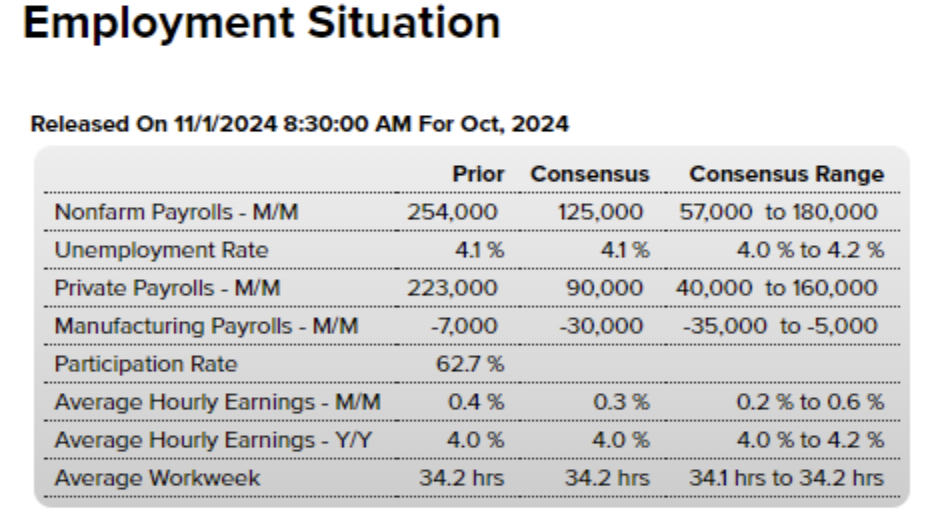

The Fed will also be watching Friday’s job data, which is set to show weakness compared to last month. However, we can blame two hurricanes for that one.

But right before I sat down to write this, someone close to me asked, “What if it all works out?”

There are certainly plenty of reasons to be bullish on stocks. And there’s still room for growth in the near term. It wouldn’t take much to gain another 6.5%, especially once the psychological barrier of the S&P 500 trading above $6000 is broken.

Let’s not forget that the markets tend to go up after an election and they are seasonally strong going into the end of the year.

My point is that it’s not all doom and gloom. Several catalysts can swing the market in either direction in the next two weeks, so keep that in mind as you size your positions and place new trades.